So Equities (buying shares in listed companies) is the top-earner among the asset classes? Does that mean you should plonk all your funds into equities? No. Not at all. “Don’t put all your eggs in one basket,” as the saying goes. Each asset class carries some risk and some benefit. The ideal […]

Author Archives: Admin

END-OF-THE-MONTH SAVING TIPS!

4 EVERYDAY SAVING TIPS My end-of-the-month saving tips have been really popular and so once again I’m happy to share this month’s list with you. There are only four this time around but they will save you a ton of money if you want to follow them. The first two focus on spending a little […]

END OF THE MONTH SAVING TIPS

5 EVERYDAY SAVING TIPS If you were to think about the choices that you make every day around what you purchase, throw away, borrow, lend and consume, you can begin to think about ways that you can spend your money more wisely and cut back on unnecessary expenses!Saving money doesn’t necessarily mean that you have […]

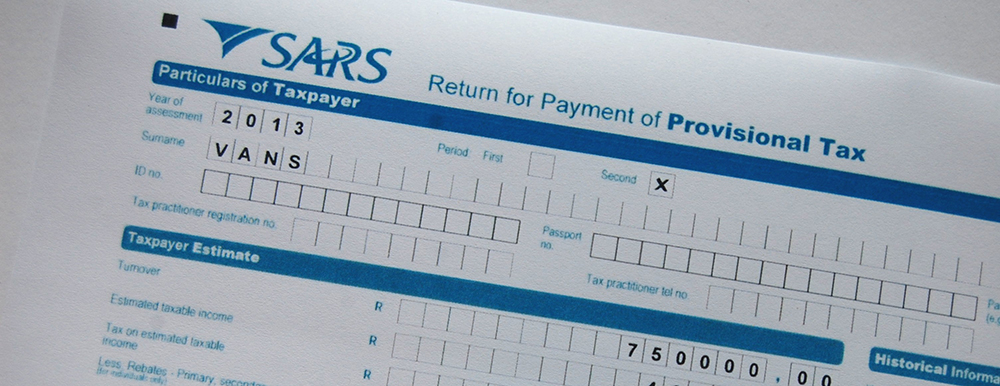

Is It Taxable?

There’s a fundamental principle of the tax system: if you make money on something, it’s taxable! This is worth bearing in mind when you’re thinking of how to invest or save. There are a lot of regulations and some exceptions, and it’s worth consulting an expert financial advisor to make sure you don’t put […]

Six Step Financial Planning Process

[dropcap2]1[/dropcap2]Introductory consultation Building a trusting relationship is the first step in creating the financial future you dream about. Being comfortable with your financial planner is essential to building a trusting relationship where you are happy to share information and ask questions. If you have any concerns or have had any bad experiences in the past […]