The root of our wealth is not in our income or our spending; it’s in our behaviour. Our habits make us wealthy, not the markets. Some have said that sound financial management comes down to spending less than we earn – but whilst this adage holds merit, it’s a lot more complicated in practice. It’s […]

Category Archives: LIFE

What’s changed in your life?

WHERE TRUE FINANCIAL PLANNING STARTS One of the best ways to make any constructive change or difference in the direction of our lives is to take a moment to observe what’s currently going on. Life whizzes by so quickly that if we don’t check in with ourselves, we will find it hard to observe and […]

Thank you, money

Some people say that magic isn’t real, but what about the first magic words we’re all taught to say? No – not “abracadabra” or “zimzalabim”, although those are great words. Abracadabra is thought to come from the Aramaic phrase “avra kehdabra”, meaning “I will create as I speak”, and zimzalabim comes from the mythological tricksters, […]

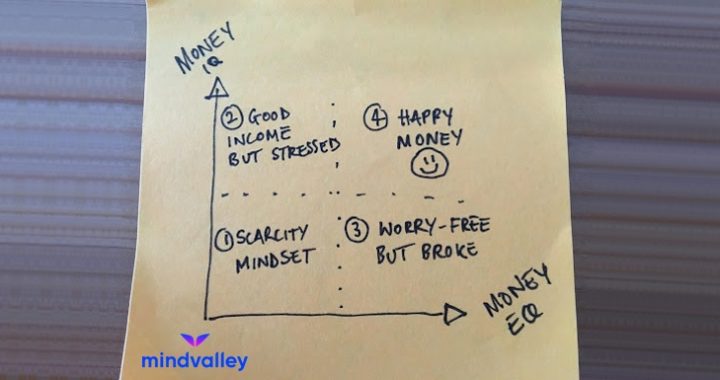

Building your Money IQ… and EQ!

Would you consider yourself to be financially intelligent? Depending on how you answer that, here’s another tough question: how much do you trust yourself to manage your own finances? Often we find that after answering the second question, clients want to go back and reanswer the first! And, that’s okay. As Ken Honda suggests, there’s […]

Re-train your brain for healthier relationships

At the heart of everything, we find relationships. Most of these are unintentional relationships that happen situationally, but some are relationships that stem from our choices. From the moment we enter the world, we will have a relationship with everyone and everything: from the space around us to the people who are present and how […]

The importance of being intentional

If we don’t stand for something, we will fall for anything. Essentially, our actions will either result from what we choose, or what is chosen for us. Our days are packed full of communication and actions. From the moment we engage with our mobile device or open our emails, messages begin to stream in and […]

Four ways to measure your fortune

We often don’t worry about something until we realise that it’s limited. If we have lots of something, it’s a fortune. If we don’t, it can become a focus of concern and anxiety. Young children generally don’t worry about much if their needs are met. With access to their parents’ love, attention and confidence, children […]

Catastrophising and how to manage it

Have you ever gone down a rabbit hole on social media? You know, that moment when you see something triggering and you click on it, and then scroll down through the comments, becoming wholly engrossed in a conversation that turns out to be a waste of time and emotional energy. While we’re in that moment, […]

How much do you need?

One of the hardest questions to answer when it comes to financial planning is: How much do I need? There are two ways we can look at this. Either, I believe that my external circumstances will eventually reach a point where I have earned enough, and I’ll finally feel that I have enough. Or, I […]

Sustainable sanity

When we stand together, we can succeed together. We can support and encourage one another. But this only happens in our smaller, more intimate groups. The fourth industrial revolution has slowly edged us into a communication environment that is overwhelmed with information. We are learning that whilst we can stand together in powerful support, we […]