Would you consider yourself to be financially intelligent? Depending on how you answer that, here’s another tough question: how much do you trust yourself to manage your own finances? Often we find that after answering the second question, clients want to go back and reanswer the first! And, that’s okay.

As Ken Honda suggests, there’s more than one type of financial intelligence, and we can work on both to be happy and prosperous.

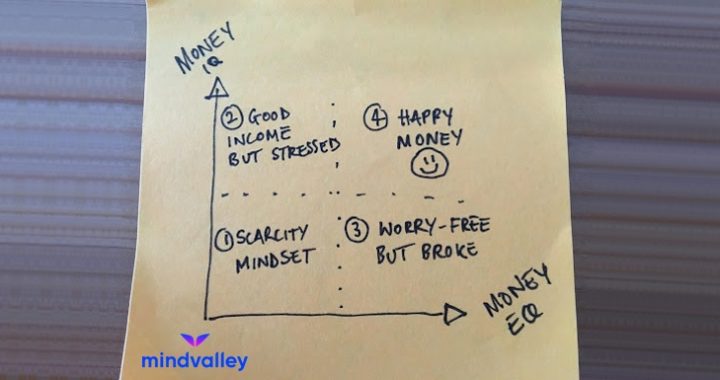

Honda, Japan’s no. 1 money teacher, helps people understand money’s true role in their lives and manage their feelings towards money. In his approach, he speaks to Money IQ and Money EQ. We have found that most people only ever discuss Money IQ or the practical accounting, money-making, investing side of money. Unfortunately, we’re never really taught how to have conversations about Money EQ — our emotional intelligence about money.

We need a healthy balance of both Money IQ and Money EQ. High Money EQ allows us to develop a much better relationship — not only with money but also with the people in our lives — and at the end of the day, all of life’s most important chances and opportunities come to us through people we know and meet.

Here’s how Honda unpacks the different stages of integration of our Money IQ and EQ:

#1 Low Money IQ – Low Money EQ

People in this category are fraught with money stress, finding themselves in a perpetual state of scarcity with seemingly no sign of upward mobility. This is where most of us begin our journey.

#2 High Money IQ – Low Money EQ

The vast majority of people fall into this category, knowing the mechanics of money, but the idea of money still carries some emotional baggage.

#3 Low Money IQ – High Money EQ

People in this category tend not to have money stress, but they don’t always have a good handle on their wealth. Interestingly enough, if you find yourself in this category, getting to the next and final stage is a lot easier!

#4 High Money IQ – High Money EQ

Here, we strike the ideal balance between handling and growing your wealth and enjoying everything our money can do for our quality of life.

There are many ways to move from one end of the spectrum to the other, and having a financial adviser help you along the way will make the process significantly easier! As we journey together, you will hopefully begin to face your finances with positivity, confident in your ability to fulfill your goals. Even after a stumble, moving forward will become much easier, freeing yourself from constrictive viewpoints about finance to avoid sabotaging yourself.

You will also find it easier to focus on what you can control and detach from what you can’t control.