Nowadays, making a transaction can feel somewhat unreal. Just a swipe and a glance at the number displayed on a digital screen. Whilst this seems easy and practical, it poses a big problem that is too-often overlooked.When we stop dealing with physical coins and notes – a mental disconnect occurs between the digital numbers and […]

Category Archives: budget

Trim your budget, not your lifestyle

Interest rates are going up again putting even more strain on our already stretched budgets. Cancelling DsTV or the daily cappuccino may be the most obvious cost cutters, but for some reason are the hardest. Here are 10 ways to reduce costs without having to give anything up.1. Settle Debt: While a savings account is […]

Back to school budgeting

During this time of the year most of our budgets are understandably depleted, with schools going back in two weeks, we should be mindful of back-to-school expenses that are around the corner.This also affords a great opportunity to chat with your kids about the costs associated with their schooling needs. Involving your children not only […]

TEACHING YOUR CHILDREN TO WORK WITH MONEY

Every parent wants the best for their children, and the best we can give them is a sure footing in life. One of these areas is intrinsically linked to how they will perceive value in others, value in themselves and the value of things around them. It is hard for children to understand the concept […]

BUDGET 2015 – HERE’S WHAT YOU NEED TO KNOW…

“Today’s budget is constrained by the need to consolidate our public finances, in the context of slower growth and rising debt.” said Minister of Finance, Nhlanhla Nene. Giving the budget speech was a far from enviable job in light of the huge government spending deficit that needs to be recovered. The speech was a short […]

10 TIPS FOR FINANCIAL PLANNING

Do you want to begin your 2015 financial year on a good note? Then what better time to review your financial plan! A financial plan provides you with the financial security to overcome unforeseen events and map out a financial future for yourself. When creating a financial plan you need to identify key achievable goals […]

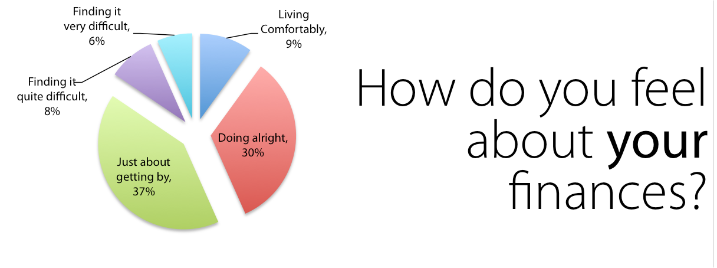

HOW DOES YOUR BUDGET SHAPE UP IN SA?

Whilst I always view clients within their unique situation and tailor their financial plans to their needs and goals, part of knowing how to guide them involves an awareness of current trends and the economic landscape. One of these measures is found in the Old Mutual Savings & Investment Monitor that was published in early […]

GAIN CONTROL OVER YOUR MONEY

There is a myth that Ostriches, when faced with danger, bury their heads in the sand. Although it is not found to be true in nature, many of us tend to behave like this when faced with our monthly budget… Financial behaviourists actually call the avoidance of perceived risky financial situations by pretending they do […]

PLANNING FOR THE UNEXPECTED

How can you plan for the unexpected… and, if you’re expecting it, then how can it be unexpected? Well, those are good questions! Planning and arranging your spending plan to include the ‘unexpected’ is a wise approach to take. When we talk about unexpected costs we generally mean services or commodities that are over-and-above what […]